Is Pet Insurance Worth the Cost? Best Pet Care Guide

By Catalog Editor Staff

Pets are like our members of the family. Similarly, they need to receive the same amount of love and care possible which is why pet insurance exists. Pet healthcare basically covers annual wellness checkups, vaccination, medication, visits with the veterinarians if necessary. This also includes other unforeseen treatments in times of accidents and health issues. Now, according to research, Americans have taken notice of the rising cost of veterinary care. In fact, this was considered to be the third largest category of pet owner’s spending in 2019, amounting to $29.3 billion and estimated to grow to $30.2 billion in 2020. However, some people ask, what makes pet healthcare necessary? Why do pet owners get pet healthcare systems? Is Pet Insurance Worth the Cost? To answer these questions, read on.

What is Pet Insurance?

As pet owners, we wanted to save expenses from veterinary consultations and medical expenditures in the event that our pets are injured or become ill. And since we could not predict the exact time when medical emergencies happen, we need some kind of financial protection. What then is a Pet insurance? By definition, it is an insurance policy bought by a pet owner which helps to efficiently cut down the overall costs of the expensive veterinary bills. Pet insurance also serves as a safety net to protect pet owners from high medical costs which mean, you pay less for covered in-network health care.

Moreover, insurance policies give preventive care for your pet animals and ensure that you are financially covered should these untoward incidents happen to your pets. The coverage is basically similar to health insurance policies for humans. However, it can seem like it is an unnecessary expense and expensive thing one can spend on but, pet insurances don’t really have to be expensive.

How pet insurance works?

Typically, pet insurance follows a simple reimbursement-based model. For example, you take your pets to the vet when it is sick, you still have to pay the full cost of pet treatments upfront, and then you, can file a claim for reimbursement. Most pet insurance policies reimburse up to 80% of costs after deductibles paid through cash or check within few days.

However, getting pet insurance does not mean that it will automatically take effect. Every plan has waiting periods to prevent fraud and it varies from company to company. The waiting period is the specific time before your coverage is officially active. This means to say that you will not be able to make a claim until your waiting period is up. For your everyday accident and illness coverage, Wagmo’s waiting period is 15 days. For cancer treatments, the waiting period is 30 days.

Also note that the reimbursement of your payment is highly dependent on your deductible, type of premium, and your Reimbursement percentage or copay. Usually, a 10% copay is the same as a 90% reimbursement level. And since your premium, deductible, annual max, and reimbursement differ from plan to plan, you should need to consider comparing each plan to choose one that will surely meet your needs.

What pet insurance covers?

Before purchasing pet health insurance, it is recommended for you to research to compare each pet insurance plan thoroughly as coverage varies per company. Usually, standard pet insurance will cover most accidents and illnesses. but listed below are the basic inclusions and exclusions of a pet health care insurance

Inclusions:

- Treatment for accidents, illnesses, & diseases

- Surgery, hospitalization, & technician care

- Diagnostic testing & imaging (X-rays, MRIs, etc.)

Exclusions:

- Dental disease

- Preexisting or hereditary conditions

- Behavior issues

- Routine checkups

- Preventive care

- Hip dysplasia

- Grooming

How much is pet insurance?

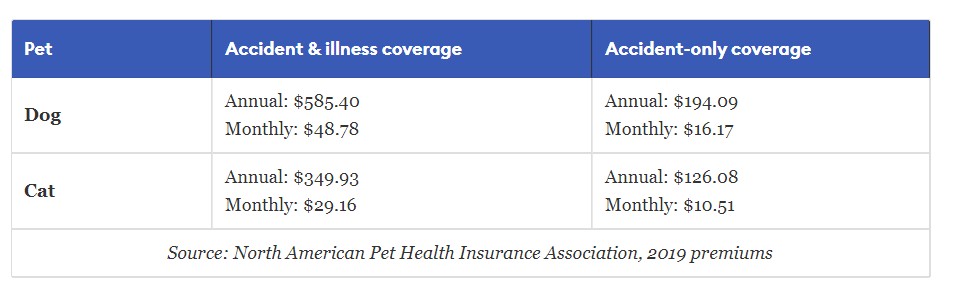

How much is the cost for pet insurance? Well, it varies. Some pet insurance companies, like Wagmo, which is featured at Catalogs.com allows you to personalize factors of your pet insurance policy to best fit your budget and your pet’s needs. Wagmo lets you choose your Pet insurance plans according to your preference as well as the coverage and price that you would like to avail. Below is a table that shows the average cost annually and monthly.

Tips on choosing a Pet Insurance company

When considering a pet insurance purchase, you need to look into different factors to make it worth it. First is, you need to compare pet insurance providers to see which one offers the best service that suits your needs. Second, check some customer reviews to make sure that the insurer’s record is good and reputable. Third, research the insurance coverage that they offer. Fourth, pick the insurance plan that suits well with your preference and your needs, and lastly, make sure that you review the Pet insurance cost and the overall Pet insurance quotes so as not to waste money. There are other insurance companies that offer deals and discounts. You might want to check them out before purchasing one.

Is pet insurance worth the money?

Popular Savings Offers

Getting a pet insurance has its own pros and cons. However, pet insurance will be very beneficial in the long run. Besides, there are a lot of insurers that offer affordable and substantial coverages. Imagine, without having pet insurance, there will be a big dent on your savings account when unforseen medical incidents happen to your pet. Purchasing an insurance gives you peace of mind, making sure these accidents, illnesses and condition does not become a concern financially when these happen. Again, your money is worth it when you are paying on good services and wide coverages. Thus, as pet owner, you need to be wise in choosing the best healthcare provider for your pets.